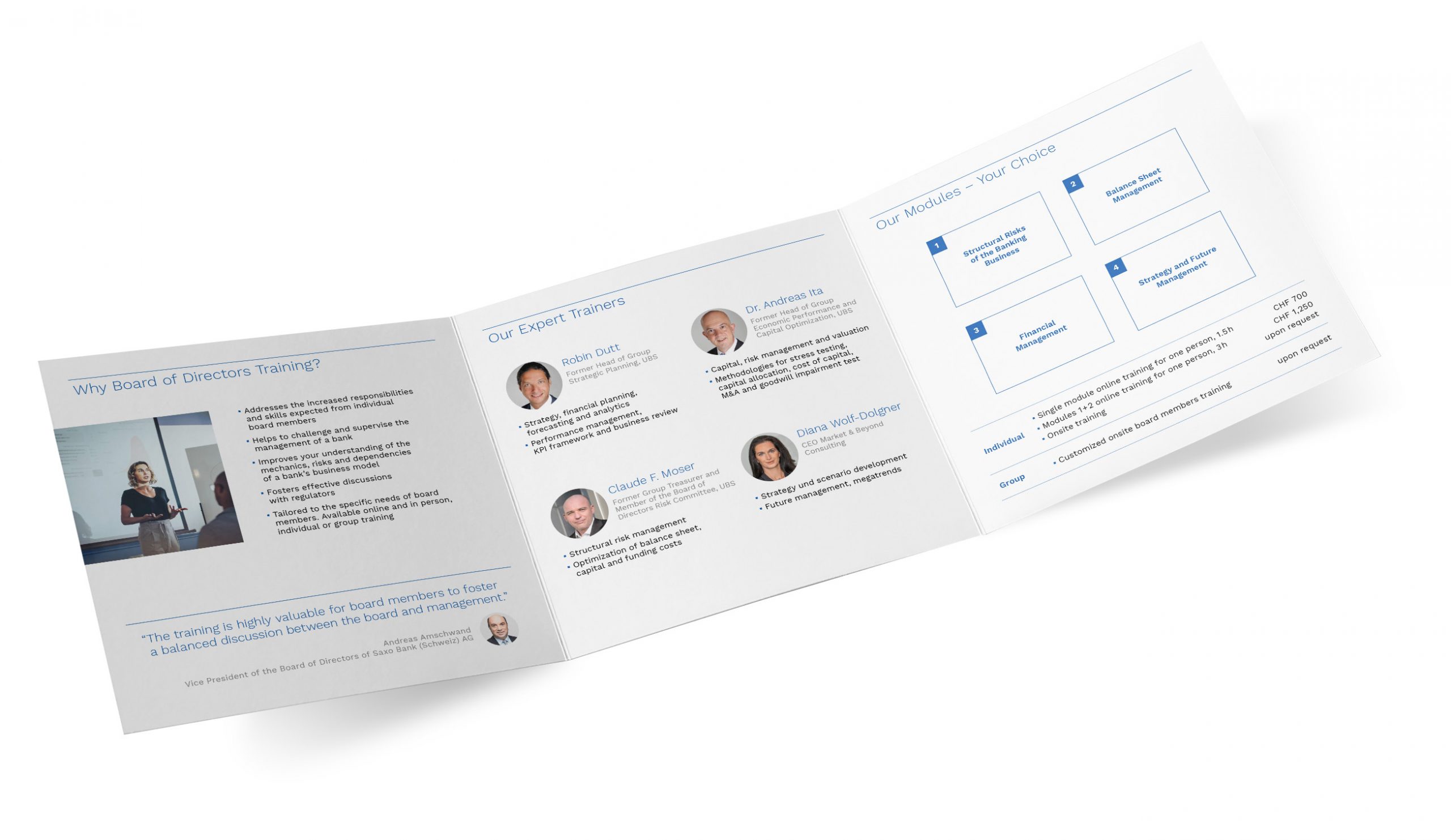

Board of Directors Training

Board members of a bank need to effectively supervise the management. Enhance your skills with our tailored board member trainings.

Brochure

Your benefits:

- Addresses the increased responsibilities and skills expected from individual board members

- Helps to challenge and supervise the management of a bank

- Improves your understanding of the mechanics, risks and dependencies of a bank’s business model

- Fosters effective discussions with regulators

- Tailored to the specific needs of board members. Available online and in person, individual or group training

“The training is highly valuable for board members to foster a balanced discussion between the board and management.”

Andreas Amschwand,

Vice President of the Board of Directors of Saxo Bank (Schweiz) AG

Our 4 Modules

-

- Reveals structural risks in a bank’s balance sheet. Explains the role of capital structure and Basel III regulation.

- Covers interest rate risk, funding and liquidity risk resulting from the maturity mismatch between loans and deposits.

- Explains the Liquidity Coverage Ratio and Net Stable Funding Ratio requirements under the Basel III framework.

- Summarizes the complex interplay between client trust, sufficient capital, liquidity and stable funding.

-

- Explains how a bank manages its assets and liabilities.

- Shows the most relevant balance sheet positions and how banks fund their assets through the issuance of liabilities.

- Describes the role of the Treasury function as bank internal intermediary and how to manage interest rate and FX risks.

- Shows the mechanics of a capital and funding plan.

-

- Explains the key drivers of income and expenses and their link to financial resources.

- Shows how to effectively steer a bank through performance dialogue, KPI Framework and financial analysis.

- Covers integrated strategic business planning and financial resources optimization.

- Introduces value-based management concepts, capital allocation and their link to shareholder value creation.

-

- Shows the impact of changes in the economic and social environment on the markets and customer needs.

- Provides to think proactively about the future - even outside of one's own field of business.

- Helps to think in alternatives and to remain confident even in uncertain times.

- How will markets, industries and customer needs develop?

Individual Trainings

Board of Directors Members Trainings

- Helps board members to better understand the mechanics, risks and dependencies of a bank’s business model

- Challenge and supervise the management of a bank

- Supports board members in their discussions with regulators

- Better understand and challenge model risks and assumptions

- Addresses the increased responsibilities and skills expected from individual board members

Executive Management Trainings

- Helps executives and management to better understand the mechanics, risks and dependencies of a bank’s business model

- Designed to train management in Risk and Finance functions to get a comprehensive integrated view on Risks, Capital, Liquidity, Funding and Treasury Management

- Supports management to successfully steer a company in a VUCA (Volatility, Uncertainty, Complexity, Ambiguity) environment and considering increasing regulatory requirements

Price

Single module online training for one person, 1.5 h

CHF 700

Modules 1 + 2 online training for one person, 3 h

CHF 1,250

Onsite training of modules 1-4 for Board Members and Executive Management

Group Seminars

Specials

- The seminars provide background information and analysis about special events that impacted banks in recent history

- Participants learn about root causes and how the event impacts bank's daily business

-

Upon request, special topics can be raised and will individually be prepared by Orbit36

Banking Fundamentals

- The seminars offer participants a broad understanding of finance, treasury and risk management topics

- Shows based on examples how to effectively manage the performance of a bank

-

Improve your understanding of the mechanics, risks and dependencies of a bank’s business model

Deep Dives

-

The seminars enable banking professionals in finance, risk and treasury to gain a profound understanding in asset and liability management, liquidity & funding, interest rate risk, financial planning & analysis and economic value add concepts

-

Enhance your expertise and learn about state-of-the art finance, treasury and risk management methods

Target Group

- Our Group Seminars are specifically designed to address the needs of professionals in the financial services industry

- Focus is on management and employees in Finance, Treasury and Risk functions, who want to get a highly efficient and effective training in their area

- The seminars offer both, seasoned professionals as well as junior careers, a broad range of topics

About the seminar:

- A critical analysis of the incident – how could this happen?

- Gain insights on risk and capital management across entities and locations

- Explains synthetic financing and the complex structure involving total return swaps

- Understand crucial gaps in international banking regulation

About the seminar:

- How does a bank funds its assets? What does a bank do with its excess liquidity?

- Which risks arise from the balance sheet?

- Explains the capital structure of a bank. What is the purpose of a Treasury function?

- What are the changes in capital regulation over the past years with Basel III?

About the seminar:

- Explains key risk components: Credit, Market and Operational Risk

- How to use stress tests in a crisis situation

- Understand the link to capital management

- What are model risks?

About the seminar:

- Components of integrated performance management and successful corporate steering including KPI framework

- Explains the link between strategy, budgeting, forecasting, investment decisions, compensation, performance monitoring and internal/external communication

About the seminar:

- What are the trends and developments for a Finance function?

- What are the success factors for strong performance management?

- How does digitalization help?

About the seminar:

- Introduces EP as value-based management concept, capital allocation and their link to shareholder value creation

- Explains key drivers of income and expenses and their link to financial resources

- Shows how to effectively steer a bank

About the seminar:

- Shows how banks make money by raising short-term deposits to fund long-term loans

- Discusses the risks created by the maturity mismatch between assets and liabilities

- Shows why it is important for banks to hold sufficiently large liquidity reserves

- Explains the Basel III Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR)

- What are the costs of the HQLA portfolio and how should it be allocated to steer the business

About the seminar:

- Shows how interest rate risk is measured and managed

- Explains the key difference between the earnings perspective and the economic value perspective

- Discusses the use and construction of replication portfolios for Non-Maturity Deposits

- Explores the use of Swaps to immunize the balance sheet against interest rate changes

- Makes the (70!) future topics and megatrends that will determine us and our customers in the coming decade transparent

- How we can use (post-corona) scenarios to validate our own future assumptions - as well as opportunities and risks

- Shows methods and tools for actively shaping the future and thinking about alternatives

Price

Individual | Min. 6 Attendees, online, 1.5 h

CHF 180 p.P.

Corporates | Onsite, Max. 20 Attendees, 2 h

CHF 2,500

All Seminars and Modules include

- Training material

- Participants get a certificate for each seminar/module attended

- The modules and seminars are held by experienced trainers who gained their expertise as practitioners in senior management roles

- Please contact us for further information