Blog

Orbit36 – 5th anniversary

It has already been five years since we established Orbit36 as management consulting boutique for banks and other financial institutions. We are taking our 5th anniversary as an opportunity to…

Orbit36-Trainings für VR-Mitglieder von Retailbanken

Die Anforderungen an Verwaltungsratsmitglieder von Schweizer Banken sind mittlerweile hoch. Die FINMA fordert von den einzelnen Mitgliedern einen einwandfreien Leumund und persönliche Reputation (Properness) sowie relevante Sachkenntnisse und berufliche Erfahrungen…

A.I. speaks about AI at Risk Live Europe 2024

At last week’s Risk Live Europe 2024 in London, Orbit36 Managing Partner Andreas Ita (A.I.) was invited to join a panel discussion about the use of Generative Artificial Intelligence (Gen…

Is UBS too big for Switzerland? – Andreas Ita shares his views in BILANZ-Business-Talk

Orbit36 Managing Partner Andreas Ita had the pleasure to be invited to BILANZ-Business-Talk broadcasted by Swiss national television (SRF1) on 26 May 2024. Under the moderation of BILANZ editor-in-chief Dirk…

Das Rätsel um den Widerspruch zwischen den gestiegenen Zinserträgen und den IRRBB-Exposures der europäischen Banken

Haben Sie sich jemals gefragt, warum der Nettozinsertrag (Net Interest Income, NII) bei den meisten europäischen Banken im Jahr 2023 gestiegen ist, während ihre Offenlegungen für das Zinsrisiko im Bankbuch…

Orbit36 quoted in the Swiss press on the Too-Big-To-Fail report

Banking regulation keeps Switzerland engaged these days. The publication of the long-awaited report on banking stability by the Swiss Federal Council on 10th April 2024 triggered an intense debate around…

Vorschläge zur Grossbankenregulierung im Nachgang an die Krise der Credit Suisse

Der Zusammenbruch der Credit Suisse im März 2023 offenbarte einige Schwächen im Swiss Too-big-To-Fail (TBTF)-Framework. Es besteht ein breiter Konsens darüber, dass das Rahmenwerk grundlegend überprüft werden muss. Am 10….

Orbit36 interviewed by Risk.net on new stress test for large US banks

Orbit36 managing partner Dr. Andreas Ita had the honour to be surveyed by the world’s leading risk management magazine Risk.net on a new element in the Fed’s 2024 supervisory stress…

Orbit36 workshop at banking book risk management conference Amsterdam

Yesterday, I returned from the 7th annual banking book risk management conference in Amsterdam, where I had the pleasure to led the post-conference workshop. We talked about the implications of…

Masterclass held at 26th capital allocation conference in London

Many thanks for the invitation to the 26th annual Basel IV implementation and capital allocation conference in London. This industry-leading conference organized by Marcus Evans brings together capital and risk…

Presentation held at Swiss Risk Association CRO Forum

On 22 November 2023, the Swiss Risk Association hosted its first CRO Forum. Over 90 Board members, Chief Risk Officers, Treasury and Risk professionals attended the event to discuss the…

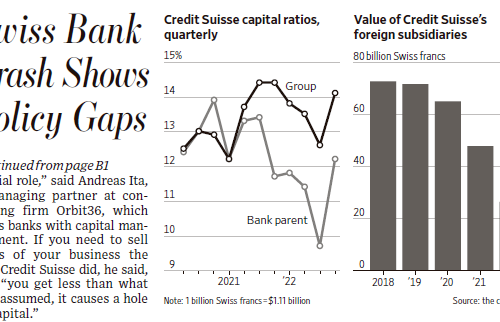

Orbit36 cited in Wall Street Journal on Swiss parent bank capital regime

Yesterday’s edition of the Wall Street Journal discusses gaps in the parent bank capital regime in Switzerland. In the article, Orbit36 emphasizes that the regulation played a crucial role in…

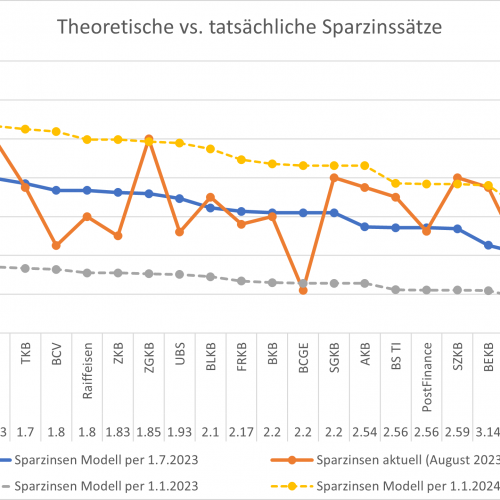

Wie Replikations-Strategien für Spareinlagen die

Wettbewerbsfähigkeit einer Bank verbessern

Vor einem Jahr bewegten sich die Zinsen in der Schweiz wieder in den positiven Bereich. Die Schweizerische Nationalbank (SNB) erhöhte ihren Leitzins in fünf aufeinanderfolgenden Schritten von -0,75% auf aktuell…

TBTF-regulation in Switzerland – quo vadis?

On Friday, the report of the group of experts on banking stability was published. In May 2023, an expert group was nominated by the Swiss government to evaluate the strategic…

JRMFI-Paper on Counterparty Credit Risk

We are pleased to share a paper published in the Journal of Risk Management for Financial Institutions. The article written by Dr. Andreas Ita discusses counterparty credit risk based on…

Wie Replikations-Strategien für Spareinlagen die Wettbewerbsfähigkeit einer Bank verbessern

Aus unserem ursprünglichen Blog-Beitrag vom 24. August 2023 ist in der Zwischenzeit ein ausführlicher deutschprachiger Artikel enstanden:

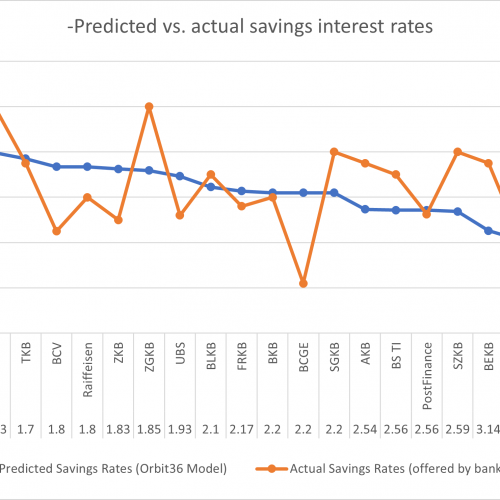

Orbit36 Analyse für Schweizerische Bankiervereinigung

Orbit36 hat im Auftrag der Schweizerischen Bankiervereinigung eine Analyse über die Entwicklung der Sparzinsen im Vergleich zu den Hypothekarzinsen durchgeführt. In der Studie untersuchen wir das Zusammenspiel zwischen den Hypothekar-…

Orbit36 expands its expertise with four seasoned banking experts

We are excited to announce the expansion of Orbit36’s expertise in strategic transformation, treasury and risk management. Effective immediately, Orbit36 offers clients additional access to its broader network of senior…

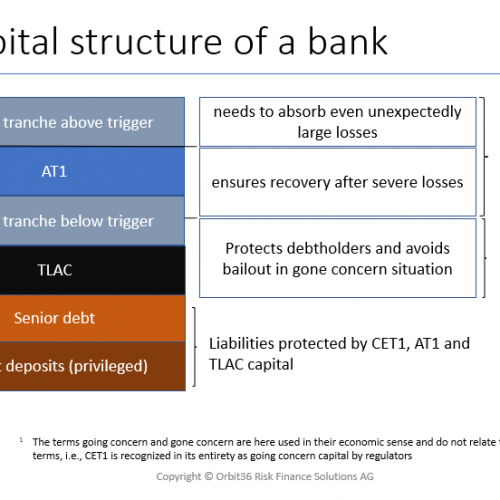

The write-down of Credit Suisse’s AT1-bonds and the Swiss TBTF-framework

As part of the merger between UBS and Credit Suisse and the additional measures implemented by the Swiss authorities, USD 17bn of AT1 instruments issued by Credit Suisse are written…

Silicon Valley Bank Collapse – Should we worry about European Banks?

The collapse of Silicon Valley Bank (SVB) end of last week sent shock waves over the global financial system. Bank stocks in the US and Europe lost between 10% and…