The UK PRA expects international banks to improve on risk management

In their “Dear CEO letter” from 10 January 2023, the Bank of England’s Prudential Authority (PRA) sets their supervisory priorities for 2023 in the areas i) financial resilience, ii) operational risk and resilience, iii) data, and iv) financial risks arising from climate change.

A strong focus is given on risk management and governance. The PRA highlighted already last year the deficiencies in banks’ risk management and governance frameworks related to the default of Archegos. It now argues that firms “continue to unintentionally accrue large and concentrated exposures to single counterparties, without fully understanding the risks that could arise”. Recent events like Russia’s invasion of Ukraine and volatility in the nickel and long-dated gilt markets are mentioned as examples which reinforced the importance of a robust risk culture and sound risk management practices.

Orbit36 has over the last two years helped banks in learning the lessons from the Archegos default. Counterparty risk management is a key area where banks have to fundamentally review their approaches, in our view. Especially for collateralized derivative positions, it is difficult for the senior management and the Board of Directors to identify large and concentrated exposures. For instance, a USD 20 billion total return swap exposure a bank had with Archegos was unaware to the firm’s Executive Board. As we have shown earlier, even exposures in this magnitude can be difficult to detect in risk reports.

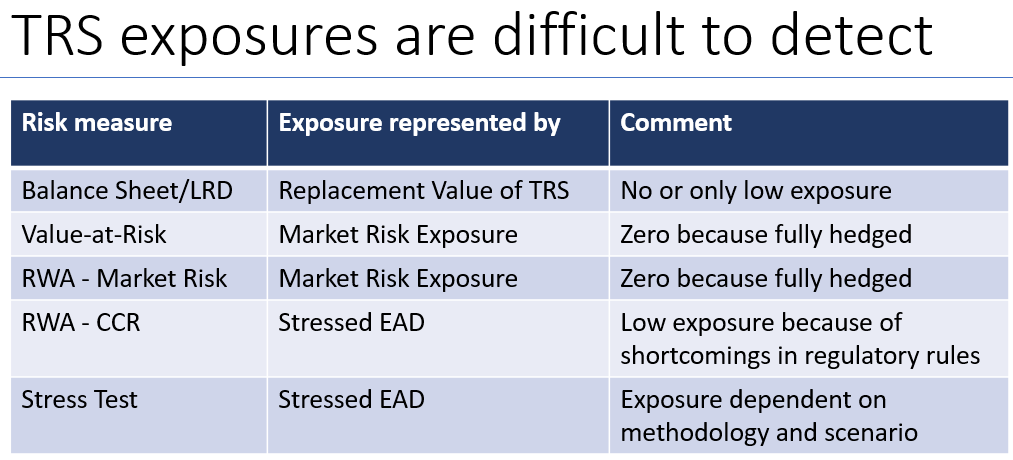

The below table shows how a total return swap exposure is reflected in commonly used risk numbers:

- A swap exposure is difficult to detect from the balance sheet, because only the replacement value has to be recognized as asset (positive value) or liability (negative value). The replacement value is solely a fraction of the deal’s notional amount, highly volatile and initially zero.

- Value-at-Risk (VaR) and Market Risk RWA are zero, since the position is hedged.

- Counterparty Credit Risk RWA are low and result in an insufficient capital requirement given the magnitude of potential losses. For instance, we estimate that the USD 20bn TRS exposure a bank had with Archegos resulted in less than 1bn of RWA under SA-CCR, the recently revised standardized approach under Basel III. This implies a CET1 requirement of around 100-150 million, which looks small compared to the losses in the magnitude of billions.

- Stress tests only reveal the high-loss potential of a counterparty default if realistic scenarios and an appropriate methodology are used. In addition, Archegos has shown that the complex legal entity booking model implemented by international banks can render ineffective regulatory stress tests.

Similar issues occurred when energy prices skyrocketed in August 2022. Banks had as clearers billions at risk, since they are liable for the margin calls their energy trading clients face on exchange traded derivatives. While the banks have to meet such margin calls from exchanges immediately, the settlement with their clients often happen with a time lag, e.g. T+1 or T+2. As we have shown in an earlier article quoted by the Wall Street Journal (https://www.wsj.com/livecoverage/stock-market-news-today-09-23-2022/card/banks-may-have-risked-billions-for-clients-in-energy-spike-NNpkePwcoyj1OBIWHNjI), Orbit36 estimates that there was a EUR 140bn margin shortfall on certain power future contracts at the European Energy Exchange (EEX) on 26 August 2022.

Orbit36 has developed alternative approaches which complement conventional risk management techniques and allow to better identify large and concentrated counterparty exposures on derivatives. Please approach us to discuss.