How to update your strategic business plan for the latest COVID-19 developments?

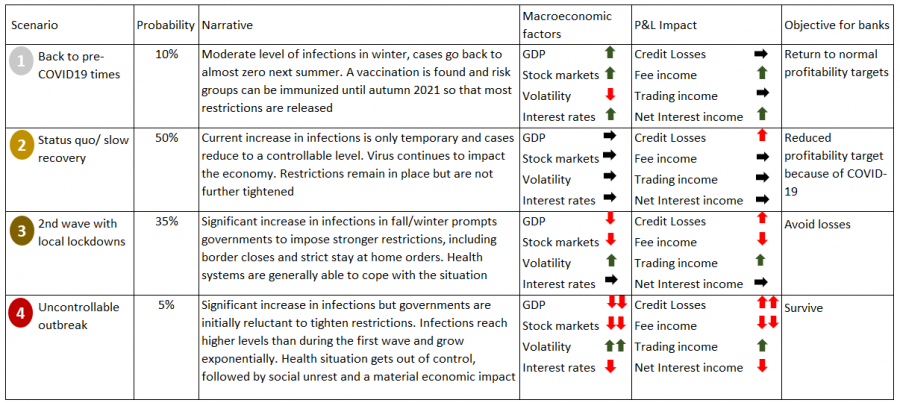

Two months ago, we outlined 4 possible scenarios for the next three years, depending on the further progression of the COVID-19 pandemia (Strategic Planning in uncertain times – A few suggestions for this year’s planning cycle). With the evidence of a second wave, we now discuss in this article how financial planners should adapt their strategic business plan to incorporate this new information.

The 2 scenarios “Back to pre-COVID19 times” and “Status quo/slow recovery” are now redundant. Today’s reality comes closest to the scenario “2nd wave with local lockdowns”, but there remains also the scenario “Uncontrollable outbreak”. Based on the information available today, we take the former scenario as starting point for the financial plan 2021-23 and update it. The latter scenario, we continue to use for the stress test.

The assumptions of scenario 2 are now already reality in a number of larger European countries. There is increasing consensus that many restrictions will remain in place at least until early spring, with a material negative impact on GDP over the next 2-3 quarters. On the other side, there is also justified hope that the situation will ease again in late spring. In addition, the probability seems high that a vaccination will be available during 2021. This would mean that a possible third waive in autumn can be handled easier and the pandemia might be largely under control in 2022.

Consequently, we assume a subdued economic activity for the coming 2-3 quarters. For expected Credit Losses, we assume an increase resulting from a higher correlation of defaults across firms and sectors. Stock markets are very difficult to predict with the combination of a deteriorating economy and massive liquidity overhangs. In light of the further downside risk, we would conservatively assume a flat to bearish market trend. A recovery could be triggered once a successful vaccination is found and rolled out to a larger fraction of the population. Therefore, we would model a recovery of the economy starting in 2022 which continues in 2023. For interest rates, we would not assume material changes from the current levels over the entire planning horizon.

The significant uncertainties observed since the start of the pandemia highlight the need for a dynamic planning process, which allows organizations to think in scenarios and to update plan projections quickly as new information becomes available. This requires robust processes and methodologies, as well as a combination of strong governance and healthy pragmatism.

Orbit36 can help you to establish financial planning and stress-testing processes, which allow your firm to navigate successfully through the most challenging times since many decades.

Scenarios from our article Strategic Planning in uncertain times – A few suggestions for this year’s planning cycle published on 4 September 2020