Orbit36 cited in Wall Street Journal on Swiss parent bank capital regime

Yesterday’s edition of the Wall Street Journal discusses gaps in the parent bank capital regime in Switzerland. In the article, Orbit36 emphasizes that the regulation played a crucial role in the downfall of Credit Suisse.

When assessing the capital adequacy of large international banks, most analysts, investors and regulators focus on the capital ratios for the consolidated Group. That banks also need to satisfy capital requirements at individual legal entity levels is frequently overlooked. A special case are the so called parent bank entities of the two big banks in Switzerland. Credit Suisse AG and UBS AG are not only operative banking entities, they also act as holding companies for businesses performed in foreign and domestic subsidiaries.

The capital regime for the parent banks in Switzerland is fairly complex. As opposed to some foreign jurisdictions where the value of investments in subsidiaries needs to be fully deducted from the capital of the parent entity, the investments are risk-weighted in Switzerland and there exist gone-concern capital requirements based on sub-consolidated exposures. When the rules were implemented in 2017, a transition period was agreed until 2028.

The Basel III framework does not prescribe national authorities the approach for the capital adequacy regulation below Group level. Against this background, it is noteworthy that some jurisdictions do not impose parent bank capital requirements (e.g. the United States) or grant exemptions (e.g. the European Union), since they regard consolidated and sub-consolidated figures as more meaningful for the supervision of banking groups.

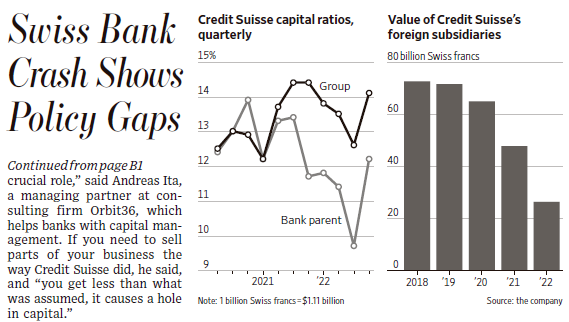

The value of Credit Suisse’s foreign subsidiaries declined by around USD 50bn over the last years. This adversely affected the capital ratios of Credit Suisse AG. In the third quarter of 2022, the CET1 ratio of the parent bank fell below the 10% requirement normally applicable. It required FINMA to grant Credit Suisse AG the permission to temporarily use its capital buffers and operate below the regulatory requirements.

As mentioned in the article, the weak capital ratios of Credit Suisse AG prevented the bank from selling or shutting down businesses when it still had time to do so. Under the current regime, the book values are often determined based on the subsidiaries’ discounted future earnings or dividends. Thus, if you get in a disposal less than what was assumed, it creates a hole in capital.

An expert group established by the Swiss government concluded in September that market participants questioned Credit Suisse’s aggregated figures because of the low parent bank capital ratios. This is plausible, since the parent bank capital ratios are difficult to interpret and numbers below regulatory requirements can be disturbing for clients and investors. We believe though that the parent bank capital ratios are less informative than the Group capital ratios. This because the parent bank capital ratios are materially driven by the assumptions used for the valuation of the participations in the subsidiaries. Nonetheless, the parent bank regulation had in our view a pro-cyclical effect and the deteriorating capital ratios reported by Credit Suisse’s parent bank contributed to the loss in confidence.

The failure of Credit Suisse revealed some fundamental weaknesses in the Swiss parent bank capital regime. Albeit it will in the future only apply to UBS, Orbit36 regards it as crucial that the parent bank capital regime will be extensively reviewed as part of a revision of the Swiss TBTF regulation. We have the necessary expertise to support regulators and policy makers in this demanding task.

WSJ-Article, beyond paywall: https://www.wsj.com/finance/banking/how-a-banking-capital-of-the-world-botched-its-own-banking-rules-ad4dcc2b