FED stress test results indicate $100bn trading loss potential for large US banks

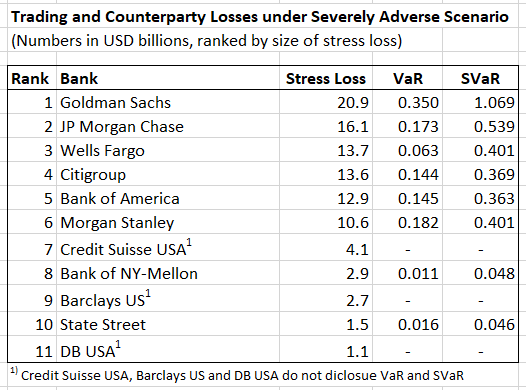

The results of the 2022 Federal Reserve Stress Test published last week reveal that the 11 largest US banks would incur combined trading losses of USD 100bn under a hypothetical stress scenario. Goldman Sachs alone showed a loss of USD 20.9bn, JP Morgan Chase USD 16.1bn, and Wells Fargo, Citigroup, Bank of America and Morgan Stanley between USD 10bn and 15bn each.1

In this article, we shed more light on the trading and counterparty loss potential of large banks and how these risks are managed and supervised internationally.

1) Trading and counterparty losses reported by the Federal Reserve (table 6, page 18), https://www.federalreserve.gov/supervisionreg/dfa-stress-tests-2022.htm

Discrepancy to Value at Risk

It is noteworthy that the trading and counterparty stress losses predicted for the above banks under the FED’s severely adverse scenario are much higher than the Value at Risk (VaR) numbers reported by the banks. As shown in the table below, the banks’ regulatory VaR and stressed VaR are mostly in the magnitude of a few hundred million USD. This large discrepancy can partly be explained by differences in scope and methodology. For instance, the FED stress test includes the loss from the assumed default of the largest trading counterparty, a risk that is captured outside of VaR.

How does it work?

The FED’s CCAR/DFAST stress test subjects 11 banks with substantial trading operations to the global market shock and/or the largest counterparty default components.

The global market shock consists of granular risk factor shocks which reflect general market distress and heightened uncertainty, apply instantaneously and differ from the macroeconomic stress scenario.2

The largest counterparty default component requires the banks to apply the global market shock on their derivatives, securities lending and repurchase agreement trading positions and then to assume the default of the largest counterparty. In addition, the Credit Valuation Adjustment (CVA) needs to be stressed for all counterparties.

By contrast, the calculation of risk-weighted assets relies on the banks’ regulatory VaR models, which commonly estimate the potential loss from market variable changes based on a 99% confidence level over a 10-day horizon.3 For Counterparty Credit Risk (CCR) RWA, large banks typically use the same VaR model (Internal Models Method, IMM) in conjunction with the IRB approach.4

2) Example: US equity market prices decline by 55% until the low in the fourth quarter of the severely adverse scenario, compared to an immediate day 1 decline of 38.3% for US equities under the global market shock

3) To convert regulatory VaR into Market Risk RWA, regulatory VaR is subject to a regulatory multiplier and then multiplied with a factor of 12.5

4) the VaR model is used to estimate Exposure at Default (EAD) under adverse market conditions, the IRB approach to determine a counterparty specific Probability of Default (PD)

Reasons for large trading stress losses

There are two fundamental differences between the FED Stress Test and the regulatory VaR/RWA calculation:

- The global market shock for equity market prices (day 1 shock) is in most cases significantly more severe than the price decline resulting from the 99% confidence level under the VaR approach

- The FED Stress Test requires the banks to assume that their largest trading counterparty unexpectedly defaults. By contrast, the CCR RWA calculation considers for each counterparty the respective Probability of Default (PD).

Due to the typical non-linearity of derivatives portfolios (e.g., short Gamma, increase in correlations), the large instantaneous market shocks under the scenario (example: 38.3% day 1 shock for US equities) tend to magnify the stress losses in an exponential way, going far beyond regulatory VaR/stressed VaR.

The assumption that the trading counterparty with the largest exposure after the global market shock unexpectedly defaults is severe. Together with the revaluation of the CVA for all trading counterparties, the stress loss is likely to exceed the expected stress loss that results from the multiplication of the stressed EAD with the PDs for the respective trading counterparties for CCR RWA.

Additional differences can arise from a different scope. While Stress Tests typically cover a bank’s entire positions, the scope of VaR models is often limited to positions with material market risk exposure.

Dangerous gaps for international banks

For the large US Bank Holding Companies (BHCs), the FED Stress Test applies for the consolidated Group, i.e., the firm’s entire worldwide activities. Foreign banks with a substantial presence in the US are subject to the FED Stress Test via their US Intermediate Holding Companies (IHCs). In this case, the scope is limited to the activities performed by the subsidiaries of the IHC. This means that foreign banks’ activities outside of the US are usually not undergoing the FED Stress Test.

After the financial crisis, many international banks established a legal entity booking model under which their client trades are booked through a UK entity. London often serves as a global hub for derivative transactions. Even if these transactions are internally transferred back into the US, e.g., via so called back-to-back transactions, the counterparty credit risk is not captured by the FED Stress Test for non-US banks. It is therefore crucial that such exposures are undergoing suitable stress tests in the UK. Archegos revealed though cracks in the co-ordination of stress tests across different jurisdictions.

Regulatory arbitrage

In their guidance for the 2021 UK Stress Test, the Bank of England’s Prudential Authority (PRA) introduced a problematic method change for collateralized OTC derivatives. For counterparty default losses, the PRA instructs the banks explicitly that “Exposures for collateralized counterparties should not be stressed and should be held constant at the current exposure”. This runs contrary to the FED’s approach, which subjects such exposures to the global market shock.

Orbit36 regards it as highly problematic that the same exposure, for instance an equity swap on a US underlying, undergoes in the US an excessive day-1 market shock of 38.3%, while it is in the UK entirely unstressed. This leaves banks plenty of room for regulatory arbitrage.

Against this background, it will be interesting to see whether the PRA will change its methodology for the 2022 UK Stress Test.

What does this mean for Board members?

The large discrepancies between VaR/RWA and stress testing results point to dangerous gaps in the Basel III framework. Those are aggravated by inconsistent stress testing approaches in different jurisdictions. It is therefore crucial that competent and attentive boards look beyond the numbers shown in risk reports and ensure the effective supervision of their institutions’ trading activities.

Orbit36 has competence to educate board members in their demanding task of supervising and challenging senior management and key risk takers. Please contact us if you wish support.