How deposit replication strategies improve the banks’ competitiveness in the savings market

A year ago, interest rates in Switzerland moved back into positive territory. The Swiss National Bank (SNB) increased its monetary policy rate in five subsequent steps, from -0.75% in June 2022 to 1.75%, currently. Until December 2022, most Swiss banks paid only marginal interest rates on savings accounts. By now, the savings interest rate has increased to around 0.75% on average, but rates vary significantly across banks.

In our latest Orbit36 analysis, we study the link between the banks’ replication assumptions for saving deposits and their interest rate pricing strategy. The analysis shows that banks which assume a longer repricing duration for their savings deposits inventory tend to offer lower savings interest rates.

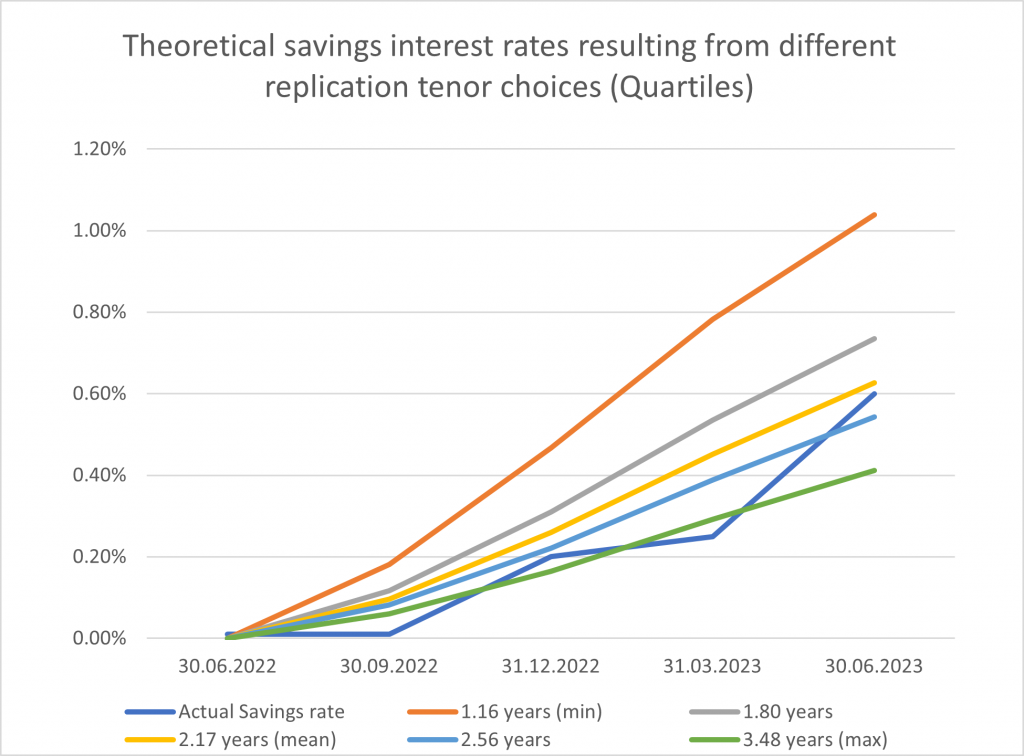

Our analysis focuses on the four systemically relevant banks in Switzerland (UBS, Postfinance, Raiffeisen and ZKB) and 15 larger cantonal banks with balance sheet totals of around 20-60 billion CHF (FINMA category 3 banks), which disclose the average interest repricing duration of their main asset and liability positions annually. While for fix-term products the average repricing duration is observable and equals the time to maturity, the banks have to rely for products with unknown interest resetting dates (Non-Maturity Deposits) on assumptions. For savings accounts, the majority of banks (2nd and 3rd quartile) assumes a repricing period between 1.8 and 2.6 years. There are though notable outliers, e.g., Graubünder Kantonalbank (1.2 years) and Walliser Kantonalbank (3.5 years).

In a first step, we assess the appropriateness of the banks’ replication assumptions in the current interest rate environment. For this purpose, we construct hypothetical replication portfolios which are identical across banks, but take into account the bank specific duration assumptions. As shown in figure 1, the banks’ replication assumptions prove to be generally robust, even considering the unusual speed of the current rate hike cycle. However, for the top quartile with the longest duration assumptions, the interest rate increases on savings deposits are higher than suggested by our deposit replication model. This partly confirms the concerns raised by the SNB in their financial stability report about too optimistic replication assumptions used by some banks in Switzerland. Assumed durations on savings accounts of 2.5 years or longer seem to be unrealistic and need to be revisited.

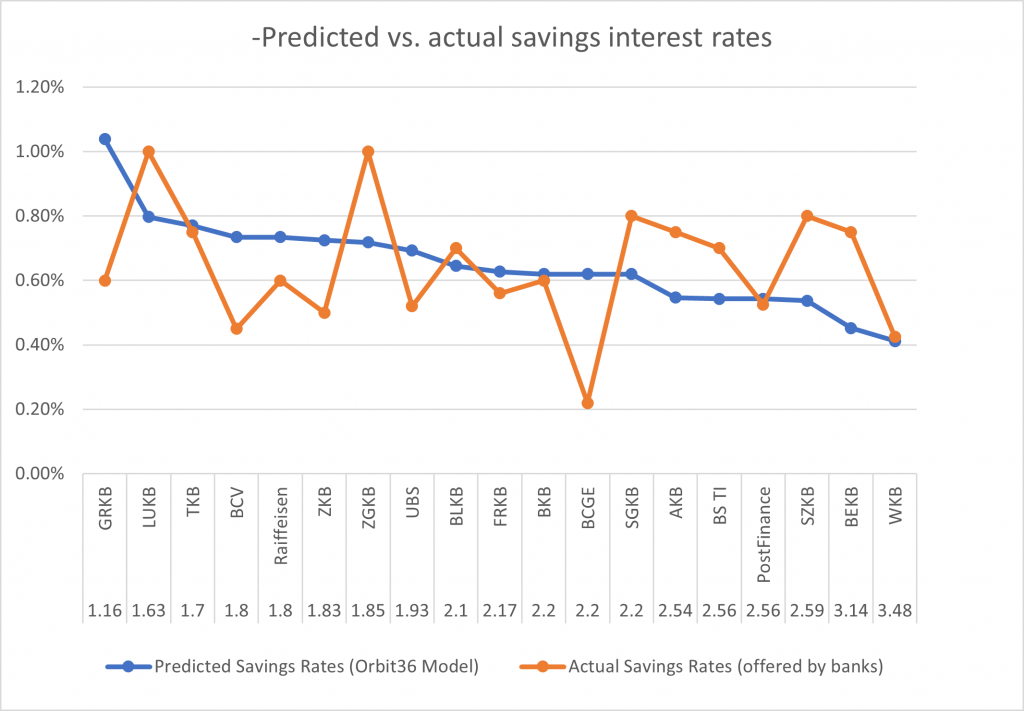

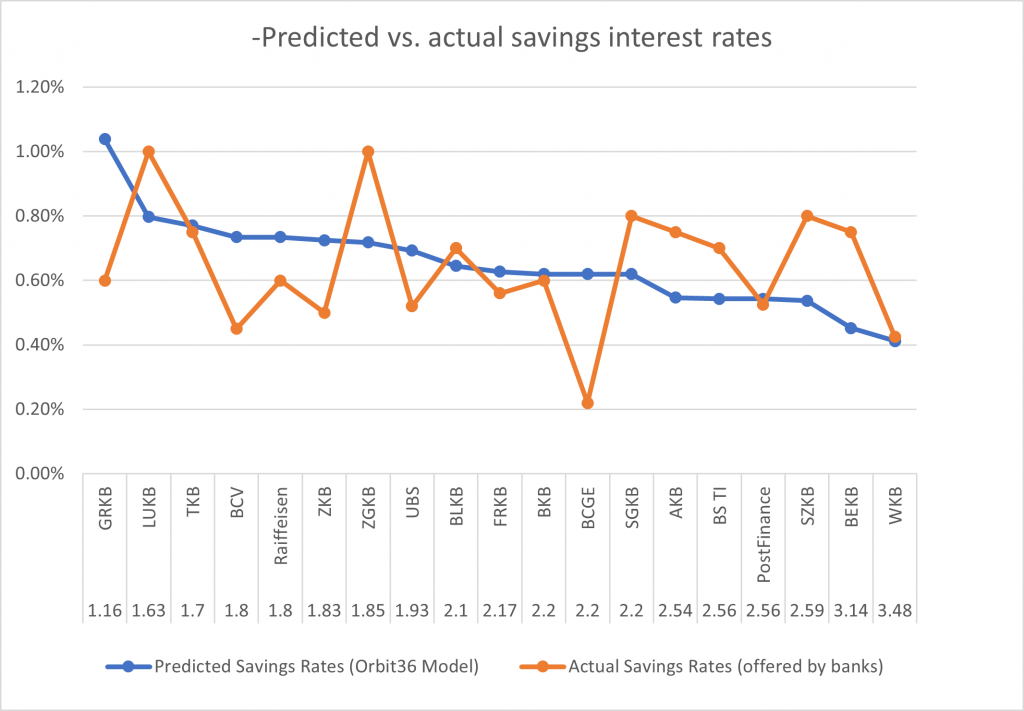

As a second part of our analysis, we estimate the theoretical savings rates which are in equilibrium with the banks’ assumed individual replication portfolio investment strategies for the respective tenors. Our Orbit36 model suggests that a bank with an average replication assumption of 2.17 years (sample median) on savings accounts could offer clients interest rates of around 0.65% per annum, by July 2023.

Figure 2: Predicted vs. actual savings interest rates This table shows the theoretical savings rates which result for a deposit replication strategy over a tenor which equals the repricing duration assumed by the respective bank (based on Pillar 2 disclosure 2022) and compares them with the actual savings rates published by the banks (as of August, 2023). (Sources: Orbit36, Pillar 2 disclosure reports and company webpages)

The results for the individual banks are shown in figure 2. According to our analysis, the bank with the longest duration assumptions (Walliser Kantonalbank, Berner Kantonalbank) could only afford savings interest rates of 0.4%-0.45% per annum without diluting margins (by 1 July 2023). This because their (hypothetical) replication portfolios with long maturities lost more in value when the market interest rates increased, compared to the average duration replication portfolio. Conversely, the short replication durations chosen by few banks on the other side of the spectrum (Graubünder Kantonalbank, Luzerner Kantonalbank, Thurgauer Kantonalbank) allowed them theoretically to offer savings interest rates of 0.75%-1% per annum, without negatively impacting margins (by 1 July 2023).

A comparison of the banks’ actual savings interest rates with our estimated theoretical savings interest rates shows a broadly consistent picture. Banks using short duration assumptions (e.g. Luzerner Kantonalbank, Thurgauer Kantonalbank) are among the most competitive bidders in the savings market. By contrast, banks with unusually long replication tenors (e.g. Walliser Kantonalbank, Berner Kantonalbank) offer below market average savings rates.

Our model suggests that the theoretical savings rates will increase by another 0.1%-0.2% per annum until 1 October 2023. The banks with short replication durations are expected to benefit the most. It will be interesting to see how these dynamics will impact the pricing decisions of the individual banks in the coming months.

Orbit36 can help your bank to improve your competitiveness through design and implementation of deposit pricing and replication strategies. Please approach us if you like to discuss.