Masterclass held at 26th capital allocation conference in London

Many thanks for the invitation to the 26th annual Basel IV implementation and capital allocation conference in London. This industry-leading conference organized by Marcus Evans brings together capital and risk management experts from banks, regulators and central banks.

Yesterday, I had the pleasure to lead the workshop “Navigating Financial Turbulence: A Masterclass on Recent Bank Failures and Regulatory Implications”. We had an engaged discussion on the factors creating increased vulnerabilities for banks.

After the Covid-19 pandemic, we experienced a few events on counterparty credit risk which indicate to high systematic risk caused by excessive leverage. The collapse of family-office Archegos was the most prominent case, where some banks lost billions in their prime brokerage units. However, there were also near misses related to the clearing of energy derivatives when gas and power prices multiplied in August 2022. A month later, a severe crisis in the UK repo market could only be avoided by the announcement of a substantial guilts purchase program by the Bank of England. All of these events had in common that the loss potential from leverage was underestimated in pillar 1 of the Basel capital adequacy framework. As a central bank representative rightly emphasized in the workshop, regulations can never capture all possible events and it is therefore crucial that banks are able to identify their specific vulnerabilities on their own, using robust pillar 2 methodologies.

The sharp increase in interest rates caused so far mainly troubles for US banks. As opposed to their European peers, US banks with total assets between USD 50bn to USD 250bn are less strongly regulated and are not subject to IRRBB rules. This allowed Silicon Vallee Bank (SVB) and First Republic Bank (FRB) to operate with Economic Value of Equity (EVE) exposures well above the 15% Tier 1 threshold applied by the ECB, the UK PRA and Swiss regulatory authority FINMA. Both banks suffered material unrealized losses on their securities investment portfolios and collapsed when clients withdrew their short-dated deposits.

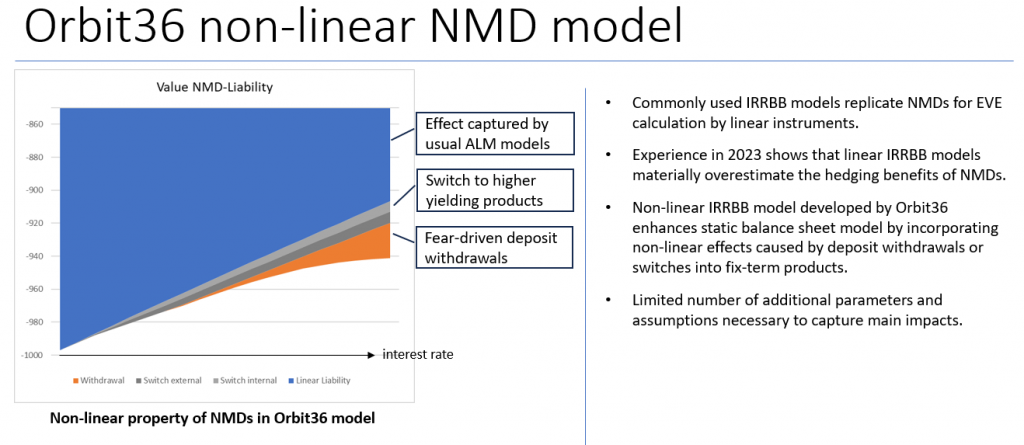

As I illustrated by an example, the IRRBB exposure of European banks depends critically on the appropriateness of the duration assumptions for Non-Maturity Deposits (NMDs). It is therefore important for banks and regulators to be aware of the risks potentially uncaptured in IRRBB. I presented a non-linear modelling approach developed by Orbit36 that allows to incorporate the impact of product switches into the EVE calculations. The model additionally captures the risk of stress-induced deposit withdrawals, which may occur after large unrealized losses on a bank’s assets.

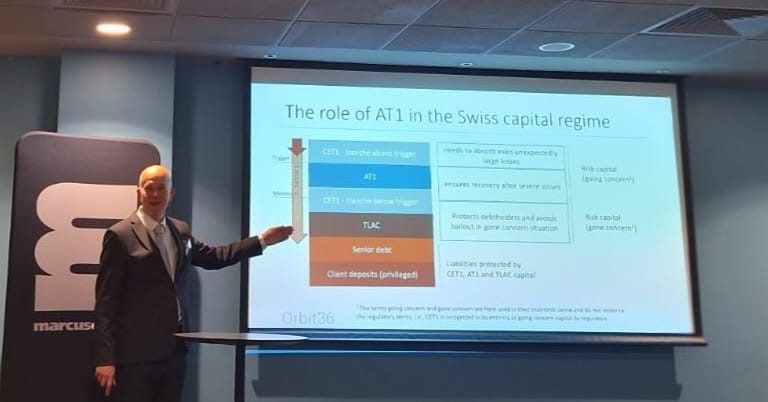

Lastly, we discussed the demise of Credit Suisse and how the G-SIB failure was handled by the Swiss authorities. Since the crisis was triggered by a loss of trust rather than an a large loss, a recapitalization of the bank made little sense and the resolution strategies could not be executed in the way original planned. Instead, it was pivotal to support Credit Suisse with fresh central bank liquidity. Since Credit Suisse had not enough collateral available to secure the emergency liquidity loans, this required the use of facilities created ad-hoc.

In my view, it is important to distinguish between solvency and liquidity crises. To address the latter, it is necessary that central banks are prepared to provide solvent banks liquidity assistance against a broad range of collateral, considering that high-quality securities are typically largely exploited when a bank needs to make use of emergency facilities. Further, the case of Credit Suisse has shown that it can be a challenge for global banks to have the collateral available in the right legal entities. The regulatory imposed ring-fencing can impede banks’ ability to access central bank facilities if the transfer of collateral across legal entities is restricted.

I am looking forward to two great further conference days!