Bank share prices imply a significant worsening in CET1 ratios

Implied CET1 ratios suggest significant loss of capital

Bank stocks have lost between 30% and 50% since their temporary highs in February. With the spreading of COVID-19 in Europe and the United States, investors are increasingly worried about a renewed banking crisis. Apparently, the biggest threat for the banking sector comes from increased credit losses in a severe and prolonged recession.

Given the high uncertainty on the impact of the pandemia and the mitigation measures taken, it is currently very difficult to estimate banks’ future capital situation. However, it can be insightful to analyze the information contained in current bank share prices.

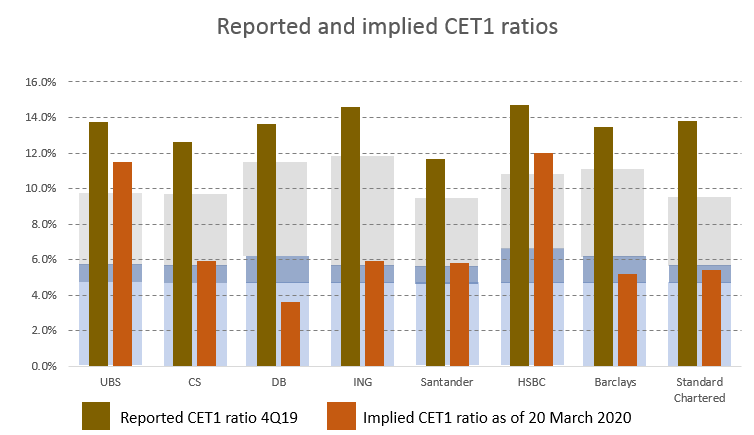

The above table shows the implied CET1 ratios for 8 global systemically important banks (G-SIB) located in Europe*. If the situation is really as bad as implied by current market capitalizations, a number of banks would have CET1 ratios close to the 4.5% BIS minimum requirement. However, as equity markets may have potentially overreacted to the current crisis, it is well possible that the implied CET1 ratios provide a too negative picture of the real situation. Nonetheless, I believe that the analysis can give a good directional view on the situation of individual institutions.

For 6 of the 8 banks covered in my analysis, the implied CET1 ratios are close to the BIS minimum requirement of 4.5% CET1. This implies that the banks’ capital buffers (e.g. capital conservation buffer, systemic risk buffer, Pillar 2 requirements) are almost entirely depleted. And in case of Deutsche Bank, not even the 4.5% minimum requirement would be met. Barclays and Standard Chartered would already have used a part of their G-SIB buffers, in addition to the fully utilized capital buffers. Credit Suisse, ING and Santander would be close but still above the sum of the minimum requirement and the G-SIB-buffer. On the positive side, UBS and HSBC would with CET1 ratios of 11.5%-12% even fully meet their capital requirements applicable in normal times.

While implied CET1 ratios based on bank stock prices give a rather gloomy picture of bank’s capital standing, there is also hope. Despite of their recent fall, prices for AT1 instruments indicate increased risk for a renewed banking crisis but do currently not point to situations where individual banks may no longer be solvent. Therefore, the low implied CET1 ratios could rather be a sign that bank stocks may have overreacted to the crisis and contain already too much negative news (see more reasons in my blog article “why are bank stocks suffering from the corona-virus”)

* French and Italian banks are excluded as capital information for 4Q19 is not yet fully available