Strategic Planning in uncertain times – A few suggestions for this year’s planning cycle

Most large firms are in the midst of their annual planning cycle. In light of the uncertainties around COVID-19, strategic planning has perhaps never been more difficult than this year. In the following, we make a few suggestions how planning and forecasting could be tackled in the current situation.

- Financial planners who still believe that a firm’s revenues and expenses follow an elaborately prescribed plan need to kiss goodbye their outdated way of thinking. Acknowledging uncertainty is the first and most important step in handling it

- Out of almost infinitively many possible scenarios, planners should map out only 3-4 scenarios which they consider as relevant based on their experience and judgment

- Because of the high level of uncertainty, financial planners should concentrate on the blurred outlines of the different scenarios to understand the rough impact on P&L and capital, including the mitigation measures the bank could take if the specific scenario was to eventuate

- In the interest of an efficient planning process, financial planners should focus on developing only one robust main scenario and evaluate the key sensitivities of the bank’s income, expenses and balance sheet/capital. Given the uncertainty of the outcome, the business plan should include potential counter measures if the main scenario does not materialize. A consistent financial plan enables the management to benchmark actuals vs plan and to decide and act quickly without re-running the entire financial planning process

- A scenario for which the probability of occurrence is low but would lead to a highly negative impact on the bank’s P&L and capital can be considered as part of stress testing. Unless the specific scenario leads to a post-stress result which is not acceptable for the firm or its regulators, the outcome under the scenario should not impact the investment and resource allocation decisions of the bank

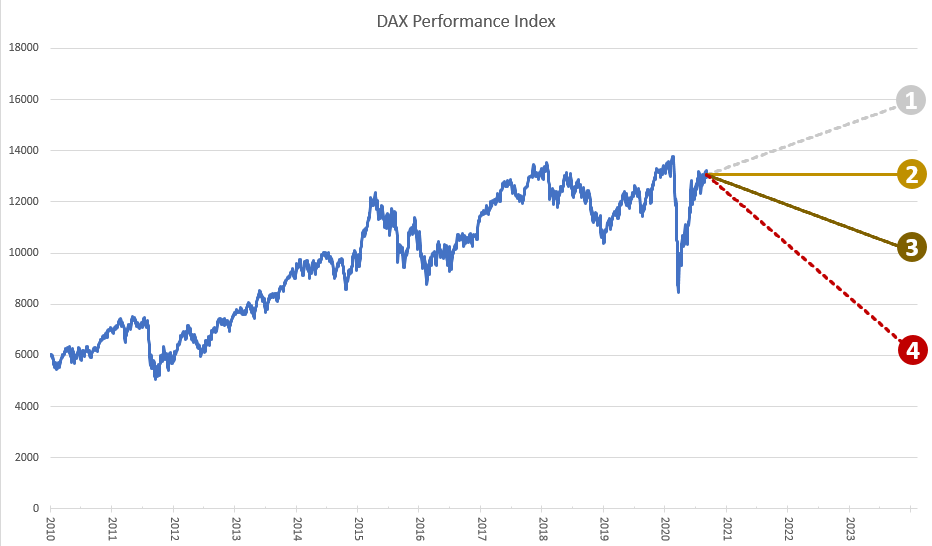

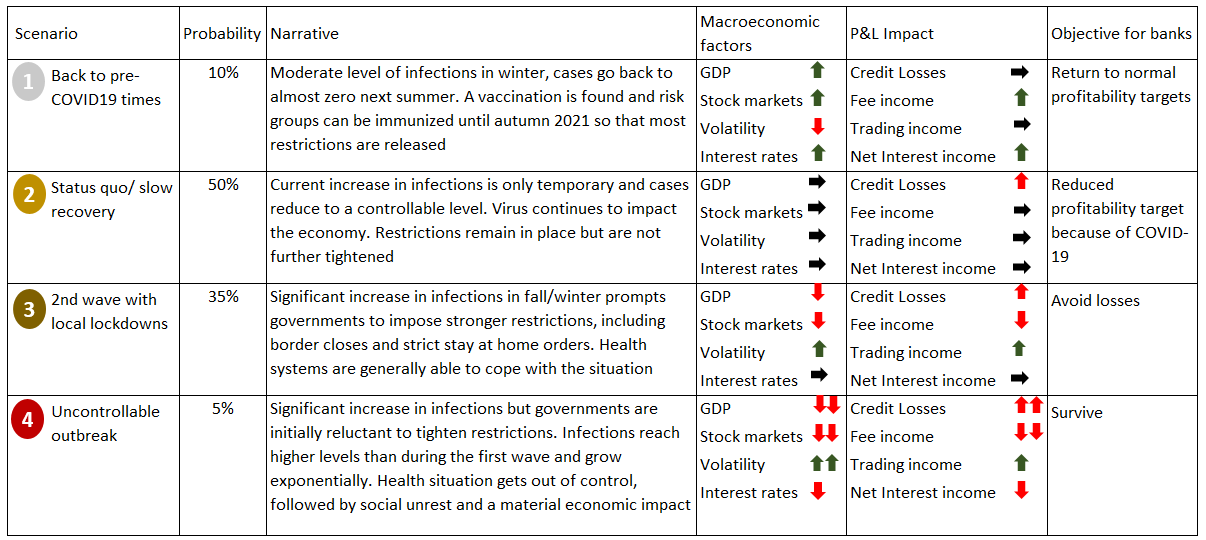

Based on the above principles, Orbit36 has outlined 4 scenarios on how COVID-19, the economy and a few key market variables could develop over the next three years. Clearly, these scenarios are not the result of a scientific study or analysis. However, we believe that our intuitive views might be helpful for planners to instruct their own scenario development.

In our view, COVID-19 will likely continue to put pressure on banks’ earnings. Unless there is a positive surprise on vaccination and/or the progression of the pandemia, banks may experience increased credit losses over the next years. Fee income directly depends on asset and stock market levels and is expected to be negatively impacted by difficult market conditions, while trading income may temporarily benefit from increased market volatility. Net Interest Income (NII) is likely to remain flat, as interest rates are not expected to change significantly given the expansive monetary policies followed by most central banks. As a consequence, banks may need to revise their profitability targets. If a second lockdown occurs and markets should follow a L-shape trend rather than the fast V-shape recovery observed in the first wave, banks may need to put most of their attention on the mitigation of losses, and dividend payments might be at risk. It is therefore recommended to proactively adapt the bank’s cost structure to the earnings achievable under the two most likely scenarios “Status quo/slow recovery” and “2nd wave with local lockdowns”. As we see a small but non-negligible risk of a worsening of the pandemia progression, we also advise banks to adapt their current dividend and capital position in a way which ensures that they can withstand an adverse pandemia situation like in the scenario “Uncontrollable outbreak”.

Orbit36 can help you to define relevant scenarios for your firm, and to design and implement methods to understand and quantify the main sensitivities of the bank’s income, expenses, balance sheet and capital ratios.