The write-down of Credit Suisse’s AT1-bonds and the Swiss TBTF-framework

As part of the merger between UBS and Credit Suisse and the additional measures implemented by the Swiss authorities, USD 17bn of AT1 instruments issued by Credit Suisse are written down and the investors loose the full amount invested in these instruments. By contrast, the shareholders get at a least fraction of their investment back. How is this possible given the usual pecking order in the capital structure, which privileges the holders of bonds over equity? Given the current discussions on this topic, we clarify a few important aspects of the Swiss “Too-big-to fail” framework.

First, it is important to understand that AT1 instruments are a hybrid between debt and equity. In Switzerland, AT1 instruments are treated as going concern capital, because the instruments include a contractual write-down clause. AT1 instruments are fully written down if either i) the issuer’s CET1 ratio falls below 7% or ii) the regulator declares a so called “non-viability event”. The latter happened yesterday in the case of Credit Suisse. The Swiss banking regulator FINMA decided that Credit Suisse’s roughly USD 17 billion of outstanding AT1 instruments are fully written down.

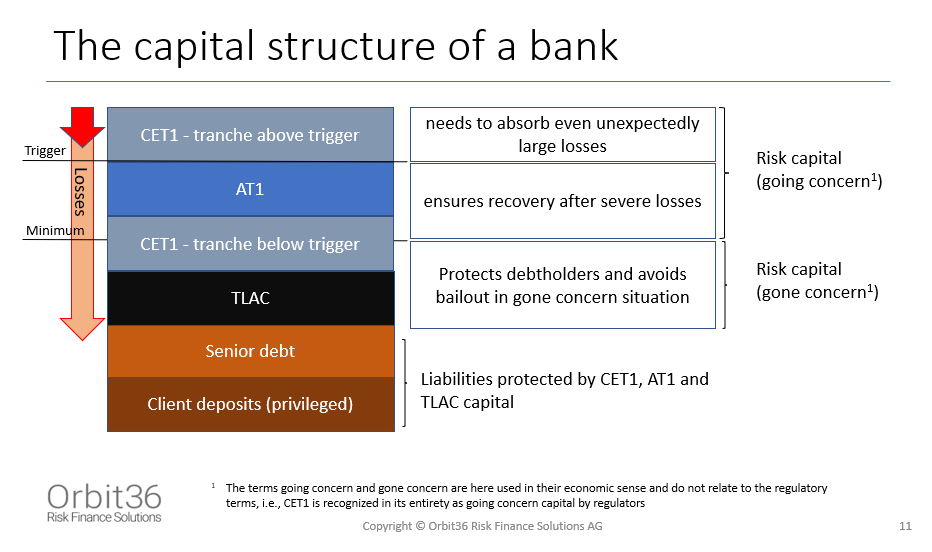

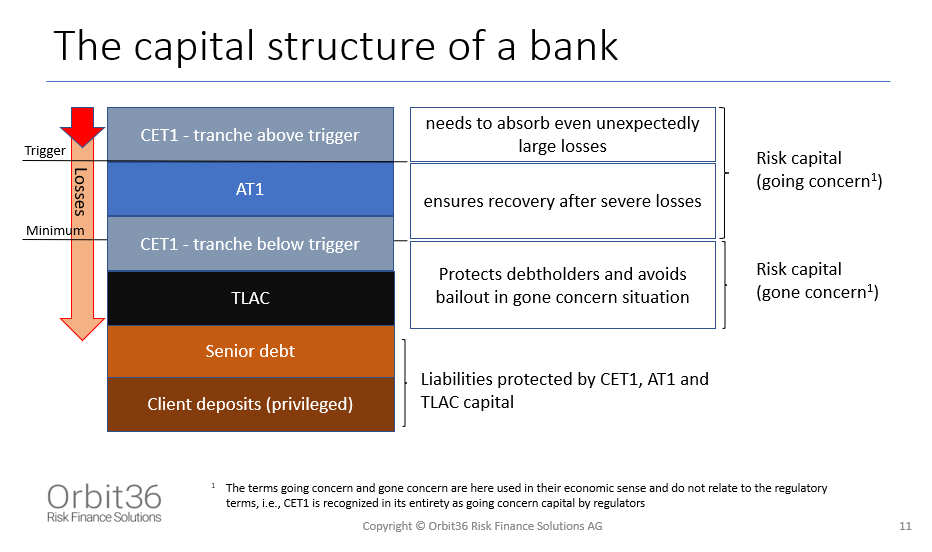

As illustrated on the below figure from the Orbit36 Board of Directors Training, AT1 instruments are an additional layer within CET1. Losses are in the first instance absorbed by the CET1 capital above the 7% threshold. In the case the issuing bank incurs large losses and the CET1 capital ratio falls below 7% (or if FINMA declares the issuer’s non-viability), the AT1 capital is written down and converts into CET1. This tranche is therefore economically junior to the CET1 capital below the 7% threshold.

The special case at Credit Suisse is that their AT1 instruments are written down in a situation where the bank’s capital ratios are still maintained and to our best knowledge no material losses incurred. The Swiss regulators even emphasized the fact that Credit Suisse always complied with its liquidity and capital requirements for systemically relevant banks. Against this background, the write-down of the AT1 instruments comes as a surprise. Presumably, FINMA decided the write-down based on a clause in the capital ordinance which requires the full write-down of AT1 instruments prior to a bank’s support by the public. As mentioned by FINMA, the write-down of the AT1 capital has increased Credit Suisse’s CET1 capital. Following the rules of the instruments, Orbit36 believes that the write-down has increased Credit Suisse’s shareholders’ equity by up to USD 17bn or roughly CHF 5 per share.

The outcome would have been very different for a bailout situation. In that case the capital of the shareholders would have been wiped-out prior to the bailout and the priority of debt over equity would have been maintained. In our view, the sound capital (but not liquidity) situation at Credit Suisse would have hardly justified this extreme measure.

As admitted by Swiss Government representatives yesterday at the media call, the situation at Credit Suisse was different from the standard scenario used under the Swiss TBTF Recovery and Resolution framework. This case will therefore likely have implications for the TBTF framework in Switzerland and perhaps also in other jurisdictions. Orbit36 has the competence to advise banks and regulators on their challenges in this demanding field. Please call us if you like to discuss.