Orbit36 quoted in the Swiss press on the Too-Big-To-Fail report

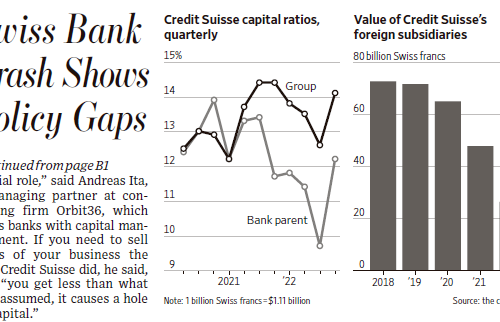

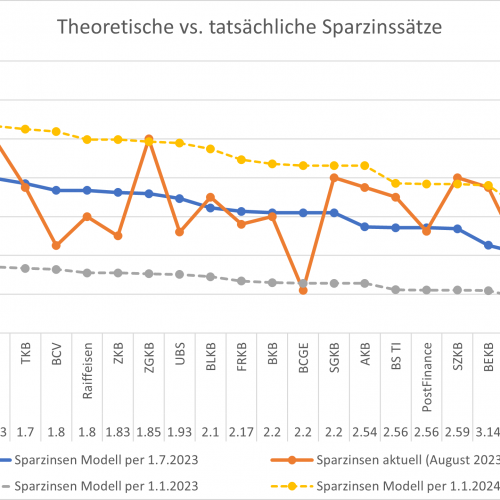

Banking regulation keeps Switzerland engaged these days. The publication of the long-awaited report on banking stability by the Swiss Federal Council on 10th April 2024 triggered an intense debate around…