Blog

Orbit36 appoints Claude F. Moser, former Group Treasurer of UBS, as Vice Chairman

We are excited to announce the addition of Claude F. Moser to the Orbit36 team. In his new role as Vice Chairman, Claude will act as senior advisor as well…

Archegos – Why some banks lost billions

Following the tremors around the default of hedge fund Archegos, some banks suffered enormous losses but others were barely hit. We take a look at why banks like Credit Suisse…

How fit are you on company valuation?

Valuations play an important role in M&A transactions and the annual testing of goodwill after an acquisition. Particularly for banks, valuations can be challenging. Senior executives and board members should…

How to update your strategic business plan for the latest COVID-19 developments?

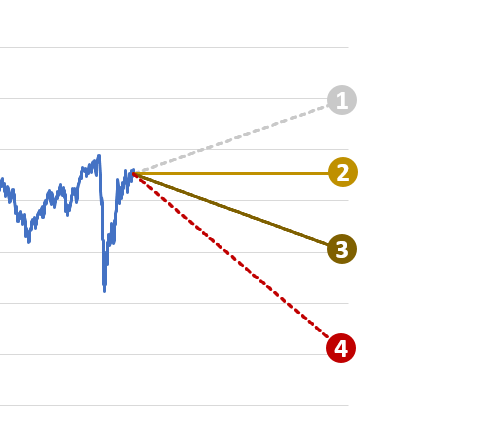

Two months ago, we outlined 4 possible scenarios for the next three years, depending on the further progression of the COVID-19 pandemia (Strategic Planning in uncertain times – A few…

When an unlikely scenario becomes reality – A few thoughts on the impact of COVID-19 on the future of stress testing

A year ago, I spoke at the Annual Bank Capital Management Conference on the usefulness of stress tests for ICAAP. If someone had asked me on that warm summer…

When the regulator grasps the thrust levers – ad-hoc banking regulation in 2020

Flying an airplane is a delicate task. Under difficult conditions, a pilot has to rely on his experience and intuition, while adhering to a complex set of rules. Applying…

Strategic Planning in uncertain times – A few suggestions for this year’s planning cycle

Most large firms are in the midst of their annual planning cycle. In light of the uncertainties around COVID-19, strategic planning has perhaps never been more difficult than this year….

Robin Dutt joins Orbit36 as Managing Partner

Message from Robin and Andreas:

With great pleasure we announce today that Robin Dutt joins Orbit36 as Managing Partner. We worked together for many years as senior managers at UBS…

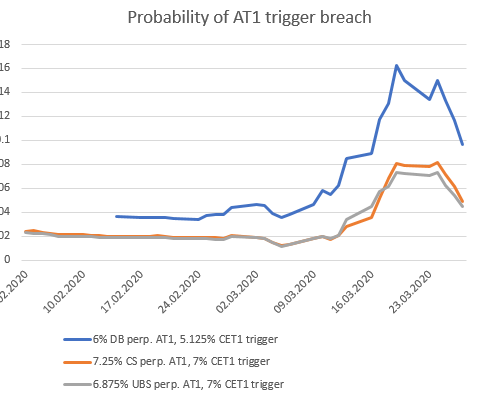

AT1 bonds imply that the economic stimulus programs have reduced the risk of a banking crisis

The prices of AT1 bonds allow to infer the probabilities with which CET1 falls below critical thresholds.

Additional Tier 1 (AT1) bonds play an important role in the capital structure…

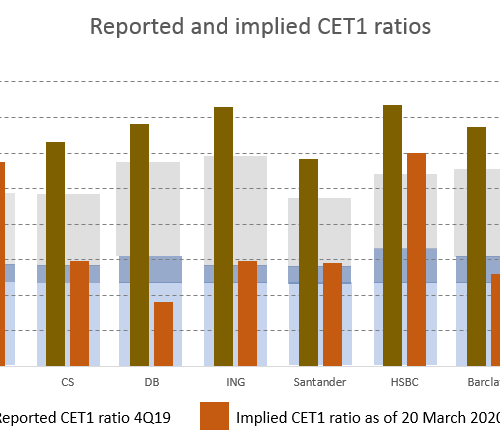

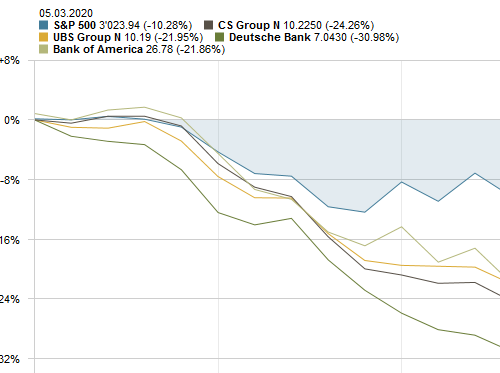

Bank share prices imply a significant worsening in CET1 ratios

Implied CET1 ratios suggest significant loss of capital.

Bank stocks have lost between 30% and 50% since their temporary highs in February. With the spreading of COVID-19 in Europe and…

Six questions I would raise as a board member of a bank these days

The strategic questions a bank management has to address.

1. Liquidity and funding risks?

a. Are there any liquidity movements which require immediate attention?

b. Withdrawals of client deposits due…

Why are bank stocks suffering from the Corona Virus?

Should we worry about the weak performance of bank stocks?

While initially financial markets were surprisingly relaxed about the outbreak of the Corona Virus in China, market sentiment has completely…

New White Paper on bank capital requirements and the cost of it

Why do banks need capital and what are the costs associated with it?

As practitioners in the banking industry, we focus a lot on regulatory capital requirements. We closely monitor…

Is the RoE of your bank above or below the fog boundary?

How much RoE should a bank achieve?

How much return on equity (RoE) should a bank make? The answer to this question is not evident. Some argue that banks can…

Tightened capital rules for large Swiss Banks

On 27 November 2019, the Federal Council announced a number of amendments to the Swiss capital ordinance, effective…

When a black swan is not coming alone – a lesson learnt during my recent trip to Japan

How likely is it that a twice in a century typhoon falls together with a magnitude five earthquake? Until recently, I would have said very unlikely. Yet, it is exactly…

Andreas Ita to speak on 23rd Annual Bank Capital Management Conference in London

Using ICAAP stress testing as a way to reveal capital sensitivities in your bank.

I am grateful to be given the opportunity to speak this year again at the Annual…

New White Paper on bank stress testing approaches

Stress testing approaches vary widely across jurisdictions.

The variety in design and methodology of supervisory stress tests is large and lacks global alignment. As a consequence, large international banking groups…

- « Previous

- 1

- 2

- 3