Blog

Banks in temporary troubles as clearers of energy firms

With skyrocketing energy prices on 26 August 2022, energy firms came in troubles and their banks faced a critical moment. The sharp price increases of future contracts on gas and…

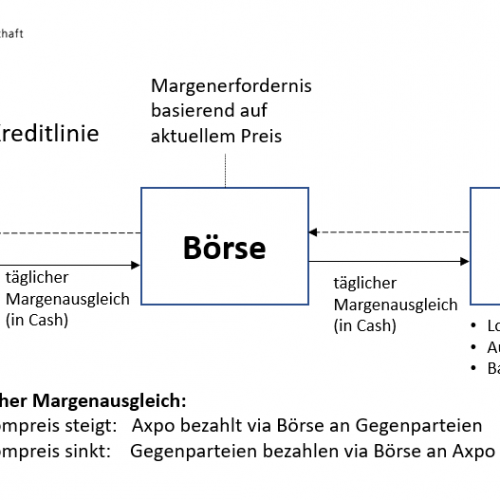

Axpo – Wohin fliessen die Bundes-Milliarden, wenn es ernst gilt?

Am 6. September 2022 hat die Axpo Holding vom Bund eine nachrangige, unbesicherte Kreditlinie von 4 Mia. CHF zugesprochen erhalten. Diese wurde notwendig, weil stark gestiegene Strompreise hohe Sicherheitsleistungen für…

Axpo – Ein gewaltiger Sturm im Wasserglas

Heute Morgen hat die Axpo Holding AG beim Bund ein Gesuch um temporäre Liquiditätshilfe eingereicht. Mittels Notverordnung hat der Bundesrat den Rettungsschirm für die Schweizer Stromwirtschaft aktiviert und der Axpo…

Orbit36 Vice Chairman quoted by NZZ am Sonntag

In yesterday’s edition of NZZ am Sonntag (published by Neue Zürcher Zeitung), award-winning editor Zoé Baches quotes Orbit36 Vice Chairman and Key Client Relationship Manager Claude F. Moser on the…

Fed vs. ECB – Why the diverging speed of monetary tightening helps US banks

With today’s 75-basis point rate increase, the Federal Reserve (Fed) continues its policy to progressively hike interest rates to combat inflation. Since the beginning of this year, the Fed raised…

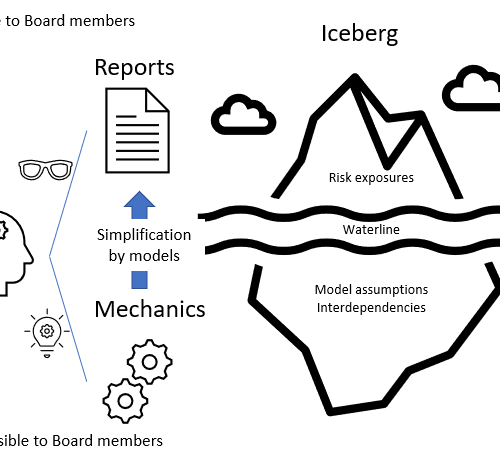

Three hidden risks below the waterline bank boards should be aware of

Navigating a bank safely through uncertain times requires expertise, experience and intuition which goes far beyond reviewing standard risk and financial reports. In the current challenging economic, political and social…

FED stress test results indicate $100bn trading loss potential for large US banks

The results of the 2022 Federal Reserve Stress Test published last week reveal that the 11 largest US banks would incur combined trading losses of USD 100bn under a hypothetical…

What does today’s SNB rate increase mean for banks in Switzerland?

In this article, Orbit36 discusses how today’s change in the SNB policy rate from -0.75% to -0.25% and the possible abandonment of the negative interest rate regime will impact the profitability of banks in Switzerland.

What banks earn from negative deposit interest rates in Switzerland

At year-end 2021, banks in Switzerland had more than a trillion of client deposits in Swiss francs on their balance sheets. The vast majority of these deposits is bearing no…

Ban of Russia from Swift – what are the risks for the banking system?

Following the decision to exclude Russian banks from the international payment system Swift as part of the sanctions against Russia to defend democratic values, we aim to shed some light…

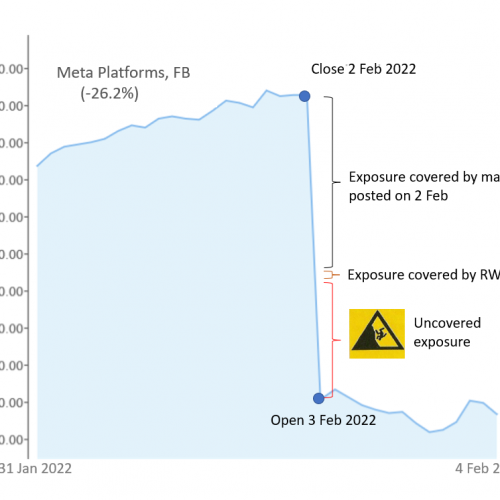

Recent jumps in FAANG stocks indicate vulnerabilities for banks

Last week, the shares of US tech giants Amazon and Facebook owner Meta Platforms showed exceptional price swings. Both shares are widely held by hedge funds. According to Reuters, eight…

Orbit36 to present at U.S. Stress Testing Conference

I feel honored to be invited as speaker to the “3rd Annual Best Practices for Stress Testing in Financial Institutions” conference in New York. This premier GFMI event brings together…

Is collateralized lending the trigger for the next stock market crash?

The collapse of two Bear Stearns hedge funds in July 2007 is in hindsight often seen as the first warning signal of the approaching financial crisis. Possibly, the default of…

Orbit36 cited in the Wall Street Journal

Orbit36 and Andreas Ita feel very honored to be quoted in the September 22, 2021 edition of the Wall Street Journal. The excellent article “Credit Suisse’s Archegos Disaster Exposes Cracks…

Credit Suisse’s Archegos case – fundamental questions remain unanswered

Following the $5.5bn loss with hedge fund Archegos, the Board of Directors of Credit Suisse appointed a Special Committee to conduct an independent external investigation of the case. The results…

Did the UK regulator disable the alert system on Archegos trades?

Prime brokerage is a global business. Investment banks and their clients will always arrange their trades in the jurisdictions that are most favourable to them. According to media reports, Archegos…

Orbit36 presence at 24th Annual Bank Capital Management Conference

We are grateful that Orbit36 was invited again this year to the Marcus Evans Annual Bank Capital Management Conference. This industry-leading event includes mainly speakers from banks, banking supervisors and…

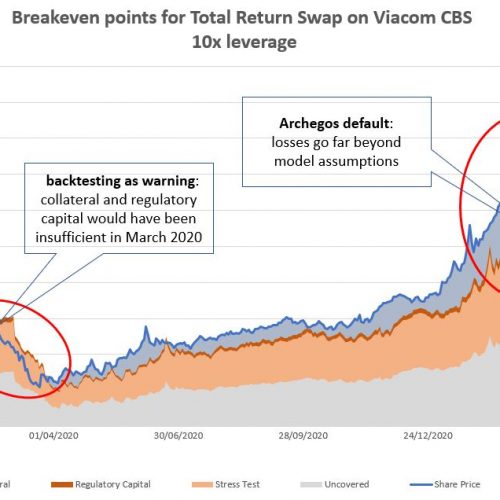

Archegos case reveals flaws in RWA calculation and Stress Testing methods

The large losses of some banks in their derivatives transactions with hedge fund Archegos indicate serious shortcomings in regulatory capital regulation and stress testing methods for collateralized OTC derivatives according…

Archegos – A déjà vue of wrong risk-return pricing?

Did Credit Suisse’s Board forget the lessons from the 2008/2009 financial crisis? A key lesson learned was that banks need to price the risks they take appropriately and that investment…

Orbit36 launches Board of Directors Training

A number of incidents in banks have shown that correctly assessing the risks is crucial to avoid losses and reputational damage. Board members of a bank need to have sufficient…

- « Previous

- 1

- 2

- 3

- Next »